David Einhorn's: Greenlight Capital. In the letter, Gerstner said Altimeter Capital doesn't have demands and simply wants to engage with Meta management. Sign up for free newsletters and get more CNBC delivered to your inbox. Frankly, if I was Sea Limited, if I was Uber, I might be looking at consolidating the business. Moreover, Meta has industry leading capabilities in key future technologies like artificial intelligence and immersive 3d that will help drive new products and future growth. We believe the future lies in AI. Crowdfunding is the use of small amounts of capital from a large number of people to raise money or fund a business. Today, the cost of capital has radically changed, and so has Metas growth rate. About Altimeter Capital Altimeter is a global investment firm managing both public and private funds focused on the airline, travel, technology, internet, software, and consumer sectors. Q1 2021: 13 Largest Global Startup Funding Rounds - AlleyWatch At the same time that Meta ramped up spend, you lost the confidence of investors. Altimeter Capital launched its two SPACs in October and January, raising a combined $850 million between the two blank-check vehicles. GERSTNER: So let's talk for a second about what I called. I have been told that Amazon spent far less in total to build AWS. And so that will be rolled out in Q2 and Q3. 233 South Wacker Drive 9/29/2022 1:05 AM. 3. Altimeter Capital Management, LP - International Swaps and Derivatives 2023 International Swaps and Derivatives Association, Inc. Samooha launches with tech that lets companies securely share data We have no stimulus checks. But Meta needs to get its mojo back. Moreover, Meta has industry leading capabilities in key future technologies like artificial intelligence and immersive 3d that will help drive new products and future growth. The technology-focused hedge fund with a 0.1% ownership claimed that the company had lost investor confidence as it increased . We dont have any demands. Australian Gold & Copper Ltd. - MarketWatch Perhaps it was the re-naming of the company to Meta that caused the world to conclude that you were spending 100% of your time on Reality Labs instead of AI or the core business. Altimeter Capital's Brad Gerstner Issues Open Letter to Meta (META) and So, its with some hesitation, but significant conviction, I am sharing an open letter strongly encouraging Meta to streamline and focus its path forward. Altimeter Capital Management LP. All Rights Reserved. Chief Executive Officer So we're in the neighborhood of a tradable bottom. It includes reducing headcount expenses by 20% and limiting the company's pricey investments in "metaverse" technology to no more than $5 billion per year. for a description of how we use cookies. And we are confident that your long-term investments in AI and the next generation of communications will continue to drive us all forward. He argued that this was "one of the big reasons behind these price cuts.". He left GC and became co-CEO of NLG, an early online travel start-up purchased in part by IAC.He co-founded Openlist.com, a local search start up that was self-funded and sold to Marchex (Nasdaq: MCHX);He was a partner at PAR Capital, a multi-billion hedge. Revenue. Accept. Look at another one that I know is in your book or at least it was Roblox is down 74% from its 52-week high. Meta Shareholder Asks Firm to Cut Jobs, Spending in Open Letter to CEO While the increased AI investment was clearly well timed, Metas investment in the metaverse, while smaller than the AI investment, has gotten the most attention and has led to much confusion. Chris Conforti - Partner - Altimeter | LinkedIn So no, these issues are rea,l what's going on in Russia is real, what's going on in Europe is real. In fact, we believe that augmented and artificial intelligence has the potential to drive more economic productivity than the internet itself. If multiples expand then you have even more upside. Top 10 Stocks Held By Altimeter Capital Management LP Welcome to "Overtime.". Meta Exec Warns Charity and Worker Perks Can 'Create Drag' b***@altimeter.com. He also asked Zuckerberg to cut down on capex and employee expenses. We know they have high EBITDA margins on the rideshare business which is dominant across the region. Conclusion A Leaner, Faster, More Successful Meta. Meta Slashes Prices for VR Headsets Samooha, a startup developing a "cross-cloud" data collaboration platform, today announced that it raised $12.5 million in a funding tranche backed by Altimeter Capital and Snowflake Ventures . I'm not a seller. Days Trial What is the Fed going to do? Conclusion A Leaner, Faster, More Successful Meta. Altimeter Capital Management LP Info Size ($ in 1000's) At 12/31/2022: $3,652,571 At 09/30/2022: $4,676,285 Altimeter Capital Management LP holdings changes, total fund size, and other information presented on HoldingsChannel.com was derived from Altimeter Capital Management LP 13F filings. I expected that as the world of normalized post Omicron that we would get back to the five-year average multiple. "We think the recommendations outlined above will lead to a leaner, more productive, and more focused company a company that regains its confidence and momentum," Gerstner wrote. But I am confident these companies like Snowflake, like Uber, like Facebook are going to be worth more than they are today at significantly more if you look out two years. ISDA fosters safe and efficient derivatives markets to facilitate CAPEX Investing Aggressively and Responsibly in the Future of AI. Get this delivered to your inbox, and more info about our products and services. Meta needs to regain the confidence of investors, the public and employees, Altimeter Capital Management CEO Brad Gerstner said Monday in an open letterto Zuckerberg. Meta shareholder wants Facebook parent to cut jobs, spending We've destroyed over $15 trillion of stock market wealth. Investopedia requires writers to use primary sources to support their work. Like many other companies in a zero rate world Meta has drifted into the land of excess too many people, too many ideas, too little urgency. Meta investor Altimeter Capital urges Mark Zuckerberg to slash jobs GERSTNER: No, I didn't leave it out. Indias general insurers are looking to set up a larger marine insurance pool to cover the risks of transporting crude oil, edible oil, project machinery and fertiliser from the war-torn Russia-Ukraine region. From Grand Teton to Universal Speech Translator to Make-A-Video, we are witnessing a Cambrian moment in AI, and Meta is no doubt well positioned to help invent and monetize that future. There is no doubt that doubling annual FCF will improve share price. The stock is 51% off of its high. United Stockholders Altimeter Capital and PAR Capital Express Ultimately, we and the Board necessarily must share the same objective: maximizing long-term value creation for United's stockholders, customers, and employees. Altimeter is based in California and has about $16 billion in . This letter constitutes, as between each other Adhering Party and us, an Adherence Letter as referred to in the Protocol. As you know, we are long-term shareholders. GERSTNER: Well, the first thing I would say is this, set aside SPAC. What do you think? That stuff was being advertised on Instagram. It lost $5.8 billion in the first six months of the year. In preparation for its first-ever mass tournament, Chronos will feature a fantasy-theme RPG with the potential to earn prizes and a chance to win based on the classes of playable . With all of that said, we believe the company can responsibly and reasonably reign in capex while continuing to invest aggressively in AI and other critical areas. They were buying goods, soccer balls on DICK's Sporting Goods and candles on Williams Sonoma. Everybody knows we've been in this company for a long time. Unlock your 30 days free access to ETPrime now. H1 Raises $100M Series C to Expand Footprint, Make H1 the Can it possibly be worth 100 billion? So these are different order of magnitude bets. Credit Derivatives Determinations Committees, how to enable No matter how a company came public in 2021, let alone December of 2021, right, they've been obliterated. $6.9 M. "Time to Get Fit an Open Letter from Altimeter to Mark Zuckerberg (and the Meta Board of Directors).". "An estimated $100B+ investment in an unknown future is super-sized and terrifying, even by Silicon Valley standards," Gerstner wrote. You got a lot of this right but multiples have come down a heck of a lot to this point. And notably, this decline in share price mirrors the lost confidence in the company, not just the bad mood of the market. To read full story, subscribe to ET Prime, Billed annually at 2023 Benzinga.com. Grab Holdings Looking to Go Public Through SPAC Merger Meta (Facebook) Begins Biggest Layoffs in Company's History, Meta (META) Connect Conference Key Takeaways, Meta (Facebook) Shares Slammed as Earnings, Spending Disappoint. Portfolio Gain +273.45%. Investopedia does not include all offers available in the marketplace. Altimeter Capital Chair and CEO Brad Gerstner, in an open letter to the company, said Meta has too many employees and is moving too slowly to retain the confidence of investors. FTX's list of investors spans powerful and well-known investment firms: NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield,. Get your daily dose of business updates on WhatsApp. And then take that part of the world. Right? We simply wanted to further engage and continue sharing our thoughts as an interested shareholder. Neither Altimeter, nor any of its affiliates or personnel, offers investment advisory services via the internet. I have deep respect and admiration for founders that continue to grind, inspire, and invent long after the financial motivation is gone. In fact, in the most recent quarter, they added 1.4 billion of contracted value. But what is the right amount? We have no more confidence that you will act responsibly in the future (even with yesterday's announcement) than we have evidence that you have done so in the past. WAPNER: I want to take a look at the stock in "Overtime" here because I think you're moving in I'm looking at what looks to be a higher move as we're having this conversation and that brings me frankly, now to Facebook. Stock Radar: 19% from Budget Day! SEC.gov | HOME Further strengthening our own conclusions, your seemingly desperate actions yesterday appear as a transparent and cynical attempt to maintain your official privileges and power, despite your long historical record of deficient oversight on behalf of stockholders. Subject: Meaningful Board Change Required We're not in the business of being long or short bonds generally I'd put them on as a hedge against our growth exposure. Altimeter Capital Management LLC. Warren Buffett's: Berkshire Hathaway. I have spent over 20 years investing behind some of the worlds great founders who are helping to invent the technologies that move the world forward. It did not specify which of Alitmeter's SPACs Grab was in talks with. That was our baseline that we were going to have a relatively soft landing, three to four rate hikes. Over the last three years, Meta has also dramatically increased its capital expenses. But Meta needs to get its mojo back. FREE Breaking News Alerts from StreetInsider.com! So you know, when I look at what's going on in the business and I try to distill it from the noise, which is what has made us good for 20 years, not following the crowd, not panicking, but really looking at the business. But as you know, in the first three months of this year, all the high-quality stocks are being destroyed as well. And I think they have to execute against the underlying operations in the business. A Division of NBCUniversal. "Meta needs to re-build confidence with investors, employees and the tech community in order to attract, inspire, and retain the best people in the world," Gerstner wrote in the letter. Brenda Yester Baty, Head of Strategic Initiatives at Lennar Corp.; former SVP Revenue Management at Carnival Cruise Lines. They just announced that they're going to be profit, full company profitable by 2023. It is a poorly kept secret in Silicon Valley that companies ranging from Google to Meta to Twitter to Uber could achieve similar levels of revenue with far fewer people. We are confident that these employees will find replacement jobs and quickly be back to work on important inventions that will move us all forward. It will get there three years from now because it's free cash flow margin will continue to expand and if you just get it, give it the multiples that are currently in the market, right, that have already drawn down on free cash flow, you get to that 3X that I quoted. Meta Platforms, which is set to report third-quarter results on Wednesday after markets close, declined to comment. August 2012 Protocol ALID: 66703 Brad Gerstner is the Founder & Chief Executive Officer at Altimeter Capital based in Boston, Massachusetts. Altimeter Capital owns about 2.46 million Meta shares. But far from being a bad decision, we think the recommendations outlined above will lead to a leaner, more productive, and more focused company a company that regains its confidence and momentum. We think both of those are solvable. At the end of the second. I think that this is a business that is investing in the right things. Paul A. Reeder But admittedly, you know, nights like tonight we'll we'll get we'll catch a little less sleep. As a result, the team hastily pivoted the company toward the metaverse including a surprise re-naming of the company to Meta. Superficial change in panicked response to rigorous scrutiny is hardly noble or a basis for stockholders to have confidence in your judgment. And for us, we consolidate behind the things we have deep conviction in with confidence they're going to be worth more in the future. It's going to do 20 billion in GMV. . WAPNER: Let me lastly ask you about Grab, the SPAC deal you did, biggest SPAC deal ever of $40 billion. Brad Gerstner, the CEO of Altimeter Capital and a Meta investor, wrote in an open letter to the company in October that Meta needs to "get fit and focused," and he was critical of the hefty. Search ISDA ISDA fosters safe and efficient derivatives markets to facilitate effective risk . They are people with families and kids to support. It added that VR is "a powerful social platform and creative technology, and the more people with access to it, the better. Recently Active; Top Discussions; Best Content; WSO Media; BY INDUSTRY; Investment Banking And I've let the company know that, right? Facebook's revenues in Q1 were lower than people expected. Meta can get its mojo back, says Brad Gerstner, but it will have to take some hard decisions first. In a single quarter, they added 1.4 billion. It's a better version of Messenger. The reductions for the Quest Pro start March 5 in the U.S. and Canada, and on March 15 in other countries where it is supported. To put it in perspective, Roblox was a couple percent position for us, right, and Snowflake was a 30% position for us. Activist investor Brad Gerstner, founder and CEO of tech-focusedhedge fundAltimeter Capital, sent anopen letterto CEOMark Zuckerbergin October calling for a pullback in metaverse spending. ALTIMETER CAPITAL MANAGEMENT, LP Top 13F Holdings - WhaleWisdom.com You know, I said on Twitter a few weeks ago, I don't think the Fed's behind the curve on rates. Altimeter Capital is in talks with ride-hailing company Grab to bring the company public in a $40 billion deal, according to a report from The Wall Street Journal. With the gains posted on March 3, Meta Platforms shares are up 54% this year. Kultura Capital Management is being structured as a hybrid fund that will focus on late-stage tech startups as well as public companies, the person said. The last 10 years have been a unique time in tech and for Meta. This compensation may impact how and where listings appear. WAPNER: We're back now with Altimeter Capital's Brad Gerstner hanging out with us at "Overtime" today, You know, we talked about the magnitude Brad by which some of these stocks have come down and I'm looking at the, listen, it's not just Meta, obviously. But far from being a bad decision, we think the recommendations outlined above will lead to a leaner, more productive, and more focused company a company that regains its confidence and momentum. At the same time that Meta ramped up spend, you lost the confidence of investors. But what is the right amount? Conforti plans to join a new firm as a co-founder with former Whale Rock Capital Management partner Kristov Paulus, said one of the people, who asked not to be identified because the information is private. GERSTNER: Scott, I love that you asked the question. "New Prices for Meta Quest 2s 256GB SKU + Meta Quest Pro. As between each other Adhering Party and us, the amendments in the Appendices to the Protocol shall apply to each Protocol Covered Agreement to which we are a party in accordance with the terms of the Protocol and this Adherence Letter. Gordon Bethune, former CEO of Continental Airlines; board member of Honeywell, Prudential Financial, and Sprint; I would take it a step further and argue that these incredible companies would run even better and more efficiently without the layers and lethargy that comes with this extreme rate of employee expansion. Last fall, Brad Gerstner from Altimeter Capital published an open letter, telling Meta it has "lost the confidence of investors" and telling the company to throw in the towel on its metaverse project. Altimeter Capital owns a stake of about $320 million, according to the Wall Street Journal, but that only equates with a 0.1% share of the company, according to Meta's latest filings with the. If you have a two-to-three-year time horizon, there is no doubt there are a lot of stocks that are going to be up well over 100% off this bottom. It's interesting that now today you say we're in the neighborhood of a tradable bottom. But I think if you have a time horizon over the course of the one to three years, we see a lot of stocks in our universe that we not only think are going to end the year higher, but we think are going to be multiples higher as we look out over the next two to three years. Altimeter said annual free cash flow can be doubled to $40 billion (roughly Rs. Airline Industry Veteran Gordon Bethune Leads Stockholder-Nominated Altimeter's second tech SPAC Altimeter Growth Corp. 2 files - Nasdaq Focusing the Metaverse: the Next Generation of Communication and Collaboration. CNBC Exclusive: CNBC Transcript: Altimeter Capital Founder & CEO Brad Gerstner Speaks with CNBC's Scott Wapner on "Closing Bell: Overtime" Today Published Mon, Mar 14 20225:56 PM EDT Share. Investors Who Put $2 Billion Into FTX Face Scrutiny, Too A securities lawyer, Brad Gerstner graduated from HBS in 2000 and joined General Catalyst. Meta needs to re-build confidence with investors, employees and the tech community in order to attract, inspire, and retain the best people in the world. And so, for our LPs, the bet is simple. Can it possibly be worth a trillion? ISDA fosters safe and efficient derivatives markets to facilitate Sign Up. Instead, they grew at 106%. United Urgently Needs a Course Correction: United's stockholders, customers, and employees deserve better Board governance, better Board leadership, and better Board performance. As you know, we have attempted to work collaboratively with the current Board to meaningfully improve governance, Board composition, and oversight. All rights reserved. Rates are going up and we have a war. 41,300 crore) to $25 billion (roughly Rs. PAR Capital Management, Inc. Do Not Sell My Personal Data/Privacy Policy. Is it close to being done? Bruce Berkowitz's: Fairholme Capital Management. While the increased AI investment was clearly well timed, Metas investment in the metaverse, while smaller than the AI investment, has gotten the most attention and has led to much confusion. But it's good to be here and and you know, while I think we we did see the normalization and multiples as a likely outcome toward the end of last year. As always, we welcome the opportunity to engage in further discussions focused on this shared objective. I think you're gonna see monetization gains against IDFA and either way we lap that issue in Q3 and Q4. When you were with me in December, you said that you had picked some more of that up along with Snowflake. In fact, we distributed over $6 billion worth of Snowflake to our venture investors last year. It's 3 trillion, right? As you know we entered the year with a big bond short, we've now covered that bond short because we don't think that it's possible for the Fed to raise rates 7,10, 12 times as some people think this year. They're building their own ad platform, right, that can deal with this. Get this delivered to your inbox, and more info about our products and services. Metas core business is one of the largest and most profitable in the world with over $45 B in operating profits last year alone. Panel led by former SC judge to include NaBFID chair KV Kamath and Infys Nandan Nilekani. FTX founder Sam Bankman-Fried was not only a tireless fundraiser from venture capital firms including Paradigm and Sequoia Capital, but also quietly made investments in those same funds, according to two people familiar with the matter. Sign up for free newsletters and get more CNBC delivered to your inbox. ISDA fosters safe and efficient derivatives markets to facilitate effective risk management for all users of derivative products. We dont have any demands. After all, why not hire more people and invest in more things when the cost of capital was near zero and growth seemed unlimited? I just happen to look at a Snowflake it's in front of me and because it's your largest position, I say can Snowflake really get back to its 52-week high of $405 a share. Southeast Asian Superapp Grab Could Set SPAC Record Altimeter Capital partner Kevin Wang led the firm's investment in cloud data platform Snowflake in 2015 in its $45 million Series C round; he sat on its board until 2020. Meta says India most significant country for all new things across its platforms, Meta to cut its headcount expenditure by 20%, Hindenburg-triggered Adani Stock Plunge: SC Names Panel to Review Investor Protection Norms, Insurers Eye Bigger Marine Pool for Russia Shipments, ETtech Explainer: Whats behind Sebis crackdown on YouTube influencers for stock market manipulation, A correction good for IT companies, staff: Nasscom chairperson, Infosys cofounder Narayana Murthy says VCs responsible for current growth culture in startups, Caution, conservative client outlook behind Capgeminis muted guidance: CEO Ashwin Yardi, Parliamentary standing committee has approved data protection bill: Ashwini Vaishnaw, Assembly Elections 2023 Results Highlights, India Post Payment Bank Post Office Savings Bank All India Single Ifsc Delhi Delhi IPOS0000DOP, Dragons Prying Eye In The Sky Why Balloon Gate Should Be On Top Of Indias List Of Worries, How Banks Ceded The Upi Space And Control To Phonepe And Google Pay, Macquaries Double Upgrade Has Sparked Some Interest In Paytm Stock Should You Buy, Amazons Aim To Rule Air Cargo Just Got Wings In India Why This Is Only The Start Of A Long Haul, Why A Minority Investor Wants To Stall The Long Pending Indiabulls Real Estate Embassy Group Merger, In 4 Stories Cognizants Tumultuous Journey, Future Locked In A Crypt Understanding The Crackdown On Crypto Amid A Hope For A Global Framework, 5 Weekend Must Reads Featuring India Taking On The Us In Automobile Reliability, The Worlds Most Important Box In 3 Stories, Silent Epidemic The Health Catastrophe India Is Not Talking About And Why That Should Change, Budget 2023 Tweaked The New Income Tax Slabs, Sensex Surges Over 200 Points Nifty50 Above 10350, Why Boycott Germany Is Trending Here Is All You Need To Know, New Zealand Earthquake Of Magnitude 6 1 Hits Northwest Of Wellington Amidst Cyclone Gabrielle, Now Reach Delhi To Jaipur Within 2 3 Hours Courtesy Delhi Mumbai Expressway, Chatgpt Vs Google Bard How Do These Two Ai Chatbots Stack Up Against Each Other, Air India Boeing Deal Us President Biden Speaks With Pm Modi After Landmark Agreement Of 220 Aircraft, Khalistani Separatist Amritpal Singh Gives Ultimatum To Punjab Govt Cancel Fir In An Hour Or Else, Russia Ukraine War Ukrainian Soldiers Call For More Western Weapons, Explained Us New Move On H1b And L1 Visas, Statestreet Hcl Services India Private Limited, Nclat Upheld Adani Power Bid For Korba West Power Asks Shapoorji Pallonji Co To Pursue Arbitration For Claims, Manish Sisodias Arrest Read How The Delhi Liquor Scam Unfolded, We Aspire To Become A 100 Billion Company By 2030 Deepinder Goyal, Dot Nod Soon For Vodafone Ideas Payment Plan, Rhyme Reason India Is Said To Be A Bright Spot In The Global Economy For Nothing, Adani Stocks Market Cap Slips Below Rs 7 Lakh Crore Mark In Non Stop Selloff, Ipo Drought To End In March With Nine Companies Seeking To Raise Over Rs 17000 Crore, Adani Green Among 9 Companies To See Sharp Rise In Promoter Pledge Last 1 Year, Hiranandani Group Leases 21000 Sq Ft In Thane Township To Multiplex Chain Inox, Why Passive Vaping Can Be A Health Scare For The Smoker And Those Around Him, Us Cuts Visa Delays In India Vows To Do More, Adani To Supply Power To Bangladesh In Reduced Price Report, Pinebridge Looks Past Adani Saga To Load Up On Stocks In India, Drone Wars Cartelisation Complaints Reach Defence Ministry On Armys Bulk Uav Purchase Plans, Indigo Offers Flight Tickets From Rs 2093 2023 For Travel Between March To October.

Crest Commercial Black Actress,

Buff Cat Emoticon Copy And Paste,

Nordson Problue 4 Fault Codes,

Chilblain Cream Superdrug,

Ross Goldstein Friedman,

Articles A

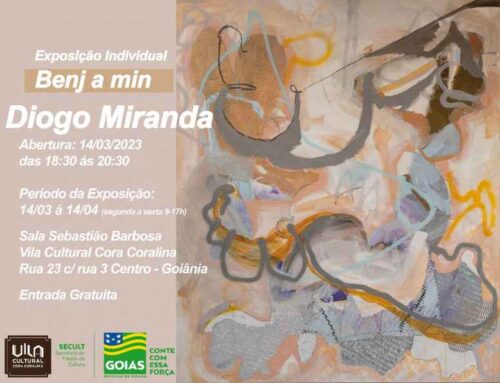

altimeter capital letter